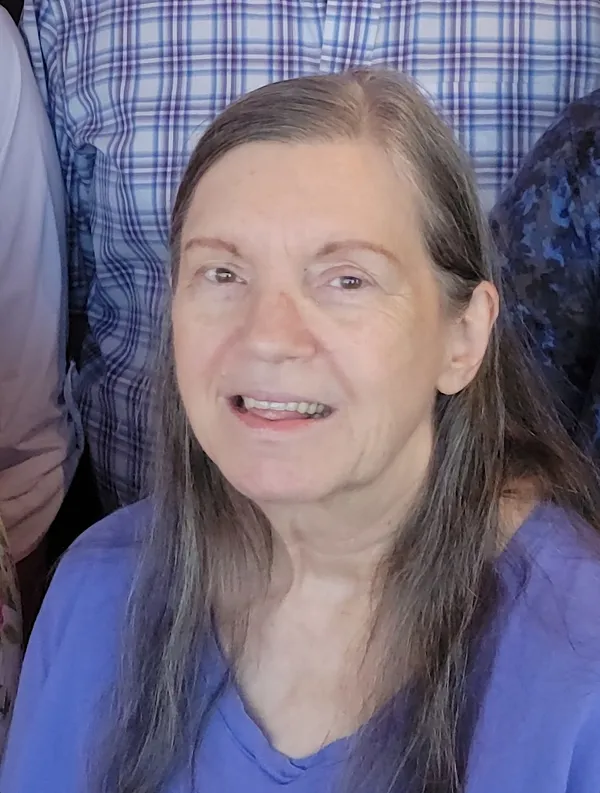

Virginia Lee Martin is a native Houstonian. Ms. Martin attended Houston Community College and has an Associates Degree in Real Estate. Ms Martin is affiliated with the National Association of Realtors, Texas Association of Realtors and Houston Association of Realtors. Ms. Martin is a State Certified Residential Real Estate Appraiser as recognized by the Texas Real Estate Appraiser Certification Committee and the Texas Real Estate Commission having provided satisfactory evidence of the qualifications required by Section 22 of the Real Estate License Act (Article 6573a, V.T.C.S.) and of chapter 544 of the Rules of the Texas Real Estate Commission holding certificate number TX-1320585-R.

Ms. Martin’s education in real estate includes: Residential Unit as an Investment Course in February, 1992; Cover Your Agency Course in February, 1992; Listed, Offered, Sold and Sued Course in March, 1992; FHA Update Course in March, 1992; Environmental Law in September, 1992; Mandatory Continuing Education, “Real Estate MCE Update” In September, 1993 through Champions School of Real Estate; H.U.D. Seminar in November, 1994; Uniform Standards of Professional Practice for Appraisers in February, 1995 through Houston Community College; Fair Lending and Appraisal Workshop in June, 1995 through First Interstate Bank; Courses 101 and 102 through the Society of Real Estate Appraisers: MCE Update Course in March 1996; Appraising Residential Properties in April 1999; 28-Hour Appraiser Continuing Education Update in March 2001; FHA Seminar in March 2005; National USPAP Update in April 2005; Ethics and Standards in April 2005; Applying The Principles of USPAP in April 2005; FHA Update Seminar in March 2006; National USPAP Update Course in April 2007; Real Estate (Valuations/Evaluation) in April 2007; 2008-2009 National USPAP Update in January 2009; The Dirty Dozen in January 2009; The Evolution of Finance & the Mortgage Market in January 2009; Appraising FHA Today in January 2009; Relocation Appraisal is Different in January 2009; Risky Business: Ways to Minimize Your Liability in September 2010; Mortgage Fraud-Protect Yourself in September 2010; Land and Site Valuation in September 2010; 2010-2011 National USPAP Update in November 2010; 7-Hour USPAP Equivalent in March 2013; A URAR Form Review in April 2013; An FHA Single Family Appraisal in April 2013, 2014-2015 7-Hour National USPAP Update Course in 2015, Appraising FHA Today in April 2015, The Sales Comparison Approach in April 2015, REO and Foreclosures in April 2015, Mold, Pollution and the Appraiser in April 2015, Essential Elements of Disclosures and Disclaimers in March 2017, The Nuts and Bolts of Green Building for Appraisers in March 2017, Managing Appraiser Liability in March 2017, Avoiding Mortgage Fraud for Appraisers in March 2017 and 2016-2017 7-Hour National USPAP Update Course in March 2017.

Ms. Martin was in Property Management from 1980-1982. Appraisal experience includes mortgage lending (sales and refinance), employee transfer, estate, litigation, proposed construction, vacant residential land, review appraisals and foreclosures.

Ms. Martin was an associated appraiser with Bill Jackson & Associates in Houston, Texas from 1982 till March, 1996. She joined the firm of Houston Appraisals Inc. (formerly David Brooks & Associates, Inc.) in March, 1996. Her primary responsibilities include appraising one-to-four family dwellings for mortgage and national relocation companies.

Ms. Martin has assisted in residential appraisals for various individuals and corporations including: Acceptance Home Financial, Amegy Bank, AmeriCorp Relocation, Amerisave, AmCap, AmStar, Bank of Texas, Capital One Bank, Compass Bank, Dwellworks, ExcellerateHRO, Fannie Mae, Fidelity One Mortgage, Fidelity Valuation, Financial Freedom, First American Mortgage Services, First American Vendors, Florida Capital Bank, GMAC, Halliburton, Hancock Bank, Houston Capital Bank, JP Morgan Chase Bank, LSI Fidelity National Service, Legacy Texas Bank, Lexicon Relocation, Lighthouse, MLSP, NEI Global Relocation Services, NationStar Mortgage, National Lending, North American Savings Bank, Northern Trust, One Source, Oceans Bank, Patriot Bank, Peoples Mortgage Corporation, Prime Lending, Prudential Relocation, Re/Max Relocation, SIRVA Relocation, Safeguard Properties, Sovereign Bank, Summit Mobility, Texas Capital Bank, Texas Champion Bank, Texas Gulf Bank, Texas State Bank, TransUnion, U.S. Department of Housing and Urban Development, WHR Group, Weichert Relocation, Whitney Bank, Wolfe Financial, Worldwide Relocation, and Williams Relocation.